Compliance

Black Diamond Risk Enterprises (BDRE) specializes in providing compliance risk consulting services in such areas as Basel II, Sox, Solvency II and Anti-Money Laundering.

A. Basel II

The 1988 Basel Accord, also referred to as the Accord or Basel I, established international minimum capital guidelines that linked banks’ capital requirements to their credit exposures. The Accord was intended to raise capital ratios and to harmonize minimum capital ratios for banks in all major jurisdictions across the world.

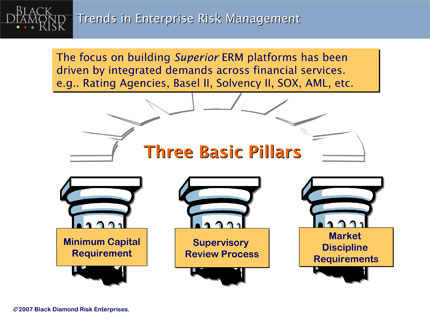

In June 1999, the Basel Committee declared its intention to build a new capital adequacy framework, known as Basel II, to replace the 1988 Accord. The overarching goal for the Basel II framework is to ensure the adequate capitalization of banks and to encourage best-practice risk management in order to strengthen the overall stability of the banking system. Specific objectives include promoting safety and soundness in the financial system, enhancing competitive equality and applying a more comprehensive approach to risk that takes into account more types of risk, such as operational and interest rate risk.

The Basel Committee developed its comprehensive framework for capital regulation around what the regulators called their “three pillars”:

- Minimum capital requirements

- Supervisory review, and

- Market Discipline

B. Sarbanes-Oxley (SOX)

The Sarbanes-Oxley legislation signed into US law in 2002 provided a huge stimulus to the development of enterprise-wide risk management. Among other things, SOX codifies:

- Corporate responsibility for financial reports (personal accountability of top corporate officers)

- Management assessment of internal controls (along with auditors attestation)

- White-collar crime penalty enhancements (significant increases in fines and penalties, including imprisonment).

More than ever, Sr. Executives are accountable for the accuracy of corporate reporting. The penalties for inaccuracy are severe. The old adage that ‘what get’s reported get’s managed’ holds true.

Risk, in all of its forms, has a tremendous effect on an organization’s bottom line. There is no reward without risk. Risk identified, evaluated and capitalized upon creates value. Risk identified, evaluated and mitigated preserves value.

C. Solvency II

Solvency II is a regulatory regime that was introduced for insurers and reinsurers in 2010. It is intended to provide a consistent harmonized framework for regulation of insurers and reinsurers across Europe. It is built on a risk-based approach to setting the capital requirements for insurers, starting from a consistent valuation of both assets and liabilities at market value.

Similar to Basel II, Solvency II incorporates a three pillar approach:

- Capital Requirements

- Supervisory Review

- Market Discipline

D. Anti-Money Laundering (AML)

The Patriot Act, which amends the Bank Secrecy Act (BSA), was adopted in response to the September 11, 2001 terrorist attacks. The Patriot Act is intended to strengthen U.S. measures to prevent, detect, and prosecute international money laundering and the financing of terrorism. These efforts include (AML) tools that impact the banking, financial, and investment communities.

Today, all financial institutions globally are required to monitor, investigate and report transactions of a suspicious nature to the financial intelligence unit of the central bank in their respective country. For example, a bank must perform due diligence by having proof of a customer’s identity and that the use, source and destination of funds do not involve money laundering.

Basel III

International Regulatory Framework For Banks

Highlights:

- Basel III: Capital(June 2011)

- Basel III: Liquidity(January 2013)

“Basel III” is a comprehensive set of reform measures, developed by the Basel Committee on Banking Supervision, to strengthen the regulation, supervision and risk management of the banking sector. These measures aim to:

• Improve the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source

• Improve risk management and governance

• Strengthen banks’ transparency and disclosures.

The reforms target:

• Bank-level, or micro-prudential regulation, which will help raise the resilience of individual banking institutions to periods of stress.

• Macro-prudential, system wide risks that can build up across the banking sector as well as the procyclical amplification of these risks over time.

These two approaches to supervision are complementary as greater resilience at the individual bank level reduces the risk of system wide shocks

Basel III phase-in arrangements:

Basel III overview table:

Regulatory Capital—Basel III the Standardized and Advanced Approach

“Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Minimum Regulatory Capital Ratios, Capital Adequacy, and Transition Provisions” (Basel III), agencies are proposing to revise their risk-based and leverage capital requirements consistent with agreements reached by the Basel Committee on Banking Supervision (Basel III). Basel III applies to all national banks and federal savings associations, collectively, banks. The Basel III proposes a new common equity tier 1 minimum capital requirement, a higher minimum tier 1 capital requirement, and, for banks subject to the advanced approaches capital rules, a supplementary leverage ratio that incorporates off-balance-sheet exposures. Additionally, consistent with Basel III, the agencies propose to apply limits on a bank’s capital distributions and certain discretionary bonus payments if the bank does not hold a specified “buffer” of common equity tier 1 capital in addition to the minimum risk-based capital requirements. The revisions set forth are consistent with section 171 of the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd–Frank), which requires the agencies to establish minimum risk-based and leverage capital requirements.

“Regulatory Capital Rules: Standardized Approach for Risk-Weighted Assets; Market Discipline and Disclosure Requirements” (Standardized Approach), agencies propose to revise and harmonize rules for calculating risk-weighted assets to enhance risk sensitivity and address weaknesses identified over recent years. Revisions include incorporating aspects of the Basel II standardized framework and alternatives to credit ratings, consistent with section 939A of Dodd–Frank. The revisions also include methods for determining risk-weighted assets for residential mortgages, securitization exposures, and counterparty credit risk. The Standardized Approach introduces disclosure requirements that would apply to U.S. bank holding companies with $50 billion or more in total assets.

“Regulatory Capital Rules: Advanced Approaches Risk-Based Capital Rule; Market Risk Capital Rule” (Advanced Approaches and Market Risk), proposes to revise the advanced approaches risk-based capital rules consistent with Basel III and other changes to the Basel Committee’s capital standards. The agencies also propose revising the advanced approaches risk-based capital rules to be consistent with section 939A and section 171 of Dodd–Frank. Additionally in this NPR, the OCC, the FDIC, and the Board propose to expand the scope of the market risk rule to apply it to federal and state savings associations and savings and loan holding companies with significant trading activity. Generally, the advanced approaches rules would continue to apply to national banks and FSAs with $250 billion or more in consolidated assets or $10 billion or more in foreign exposure.

The Basel III and Standardized Approach include addenda that provide a summary of the proposed rules that are more relevant for community banks. The agencies intend for these addendums to act as a guide for community bankers, helping them to navigate the proposed rules and identify the changes most relevant for their institution. The addenda do not, however, by themselves provide a complete understanding of the proposed rules and the agencies expect and encourage all banks to review the proposed rules in their entirety.