Operational Risk

Black Diamond Risk Enterprises (BDRE) provides operational risk consulting services where operational risk refers to potential losses resulting from inadequate systems, management failure, faulty controls, fraud, human error and so on.

We also work with organizations to reduce fraud, and control technology risk. Examples of fraud are numerous and include employees who intentionally falsify and/or misrepresent the risks incurred in a transaction. Technology risk, principally computer systems risk, also falls into the operational risk category.

We also work with organizations to reduce human factor risk. It relates to the losses that may result from human errors, such as pushing the wrong button on a computer, inadvertently destroying a file, or entering the wrong value for the parameter input of a model.

- Active Operational Risk Portfolio Management

- Basel II & III

- Benford's Law

- Business Continuity Planning (BCP)

- Business Process Management (BPM)

- Capital Management

- Cyber Risk

- Disaster Recovery

- Legal and Regulatory

Compliance Risk - Liquidity Management

- Performance Measurement & Compensation

- Rating Agency Review

- Risk Management Information Systems (RMIS)

- Stress Testing

- Subject Matter Expertise / Testimony

- Supply Chain Optimization

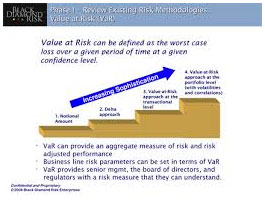

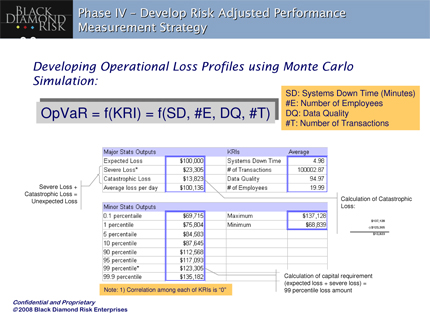

- Value at Risk (VaR)

- Vendor Selection

Benford’s Law

A phenomenological law also called the first digit law, first digit phenomenon, or leading digit phenomenon. Benford’s law states that in listings, tables of statistics, etc., the digit 1 tends to occur with probability ![]() , much greater than the expected 11.1% (i.e., one digit out of 9). Benford’s law can be observed, for instance, by examining tables of logarithms and noting that the first pages are much more worn and smudged than later pages (Newcomb 1881). While Benford’s law unquestionably applies to many situations in the real world, a satisfactory explanation has been given only recently through the work of Hill (1998).

, much greater than the expected 11.1% (i.e., one digit out of 9). Benford’s law can be observed, for instance, by examining tables of logarithms and noting that the first pages are much more worn and smudged than later pages (Newcomb 1881). While Benford’s law unquestionably applies to many situations in the real world, a satisfactory explanation has been given only recently through the work of Hill (1998).

Benford’s law was used by the character Charlie Eppes as an analogy to help solve a series of high burglaries in the Season 2 “The Running Man” episode (2006) of the television crime drama NUMB3RS.

Benford’s law applies to data that are not dimensionless, so the numerical values of the data depend on the units. If there exists a universal probability distribution ![]() over such numbers, then it must be invariant under a change of scale, so

over such numbers, then it must be invariant under a change of scale, so

|

(1)

|

If ![]() , then

, then ![]() , and normalization implies

, and normalization implies ![]() . Differentiating with respect to

. Differentiating with respect to ![]() and setting

and setting ![]() gives

gives

|

(2)

|

having solution ![]() . Although this is not a proper probability distribution (since it diverges), both the laws of physics and human convention impose cutoffs. For example, randomly selected street addresses obey something close to Benford’s law.

. Although this is not a proper probability distribution (since it diverges), both the laws of physics and human convention impose cutoffs. For example, randomly selected street addresses obey something close to Benford’s law.

If many powers of 10 lie between the cutoffs, then the probability that the first (decimal) digit is ![]() is given by a logarithmic distribution

is given by a logarithmic distribution

|

(3)

|

for ![]() , …, 9, illustrated above and tabulated below.

, …, 9, illustrated above and tabulated below.

| 1 | 0.30103 | 6 | 0.0669468 |

| 2 | 0.176091 | 7 | 0.0579919 |

| 3 | 0.124939 | 8 | 0.0511525 |

| 4 | 0.09691 | 9 | 0.0457575 |

| 5 | 0.0791812 |

However, Benford’s law applies not only to scale-invariant data, but also to numbers chosen from a variety of different sources. Explaining this fact requires a more rigorous investigation of central limit-like theorems for the mantissas of random variables under multiplication. As the number of variables increases, the density function approaches that of the above logarithmic distribution. Hill (1998) rigorously demonstrated that the “distribution of distributions” given by random samples taken from a variety of different distributions is, in fact, Benford’s law (Matthews).

One striking example of Benford’s law is given by the 54 million real constants in Plouffe’s “Inverse Symbolic Calculator” database, 30% of which begin with the digit 1. Taking data from several disparate sources, the table below shows the distribution of first digits as compiled by Benford (1938) in his original paper.

| col. | title | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | samples |

| A | Rivers, Area | 31.0 | 16.4 | 10.7 | 11.3 | 7.2 | 8.6 | 5.5 | 4.2 | 5.1 | 335 |

| B | Population | 33.9 | 20.4 | 14.2 | 8.1 | 7.2 | 6.2 | 4.1 | 3.7 | 2.2 | 3259 |

| C | Constants | 41.3 | 14.4 | 4.8 | 8.6 | 10.6 | 5.8 | 1.0 | 2.9 | 10.6 | 104 |

| D | Newspapers | 30.0 | 18.0 | 12.0 | 10.0 | 8.0 | 6.0 | 6.0 | 5.0 | 5.0 | 100 |

| E | Specific Heat | 24.0 | 18.4 | 16.2 | 14.6 | 10.6 | 4.1 | 3.2 | 4.8 | 4.1 | 1389 |

| F | Pressure | 29.6 | 18.3 | 12.8 | 9.8 | 8.3 | 6.4 | 5.7 | 4.4 | 4.7 | 703 |

| G | H.P. Lost | 30.0 | 18.4 | 11.9 | 10.8 | 8.1 | 7.0 | 5.1 | 5.1 | 3.6 | 690 |

| H | Mol. Wgt. | 26.7 | 25.2 | 15.4 | 10.8 | 6.7 | 5.1 | 4.1 | 2.8 | 3.2 | 1800 |

| I | Drainage | 27.1 | 23.9 | 13.8 | 12.6 | 8.2 | 5.0 | 5.0 | 2.5 | 1.9 | 159 |

| J | Atomic Wgt. | 47.2 | 18.7 | 5.5 | 4.4 | 6.6 | 4.4 | 3.3 | 4.4 | 5.5 | 91 |

| K | 25.7 | 20.3 | 9.7 | 6.8 | 6.6 | 6.8 | 7.2 | 8.0 | 8.9 | 5000 | |

| L | Design | 26.8 | 14.8 | 14.3 | 7.5 | 8.3 | 8.4 | 7.0 | 7.3 | 5.6 | 560 |

| M | Reader’s Digest | 33.4 | 18.5 | 12.4 | 7.5 | 7.1 | 6.5 | 5.5 | 4.9 | 4.2 | 308 |

| N | Cost Data | 32.4 | 18.8 | 10.1 | 10.1 | 9.8 | 5.5 | 4.7 | 5.5 | 3.1 | 741 |

| O | X-Ray Volts | 27.9 | 17.5 | 14.4 | 9.0 | 8.1 | 7.4 | 5.1 | 5.8 | 4.8 | 707 |

| P | Am. League | 32.7 | 17.6 | 12.6 | 9.8 | 7.4 | 6.4 | 4.9 | 5.6 | 3.0 | 1458 |

| Q | Blackbody | 31.0 | 17.3 | 14.1 | 8.7 | 6.6 | 7.0 | 5.2 | 4.7 | 5.4 | 1165 |

| R | Addresses | 28.9 | 19.2 | 12.6 | 8.8 | 8.5 | 6.4 | 5.6 | 5.0 | 5.0 | 342 |

| S | 25.3 | 16.0 | 12.0 | 10.0 | 8.5 | 8.8 | 6.8 | 7.1 | 5.5 | 900 | |

| T | Death Rate | 27.0 | 18.6 | 15.7 | 9.4 | 6.7 | 6.5 | 7.2 | 4.8 | 4.1 | 418 |

| Average | 30.6 | 18.5 | 12.4 | 9.4 | 8.0 | 6.4 | 5.1 | 4.9 | 4.7 | 1011 | |

| Probable Error |

The following table gives the distribution of the first digit of the mantissa following Benford’s Law using a number of different methods.

| method | Sloane | sequence |

| Sainte-Lague | A055439 | 1, 2, 3, 1, 4, 5, 6, 1, 2, 7, 8, 9, … |

| d’Hondt | A055440 | 1, 2, 1, 3, 1, 4, 2, 5, 1, 6, 3, 1, … |

| largest remainder, Hare quotas | A055441 | 1, 2, 3, 4, 1, 5, 6, 7, 1, 2, 8, 1, … |

| largest remainder, Droop quotas | A055442 | 1, 2, 3, 1, 4, 5, 6, 1, 2, 7, 8, 1, … |

Cyber Risk

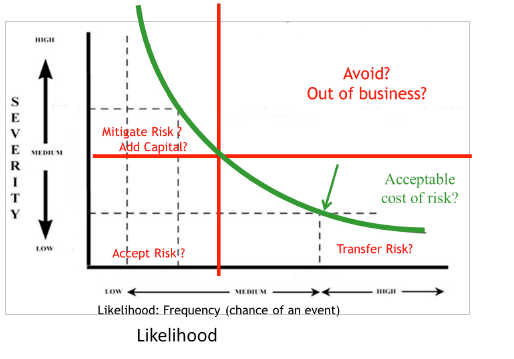

Challenge: Managing acceptable cost of cyber risk.

Solution: Construct Likelihood and Frequency measures